When embarking on the process of establishing a business in Estonia, it's crucial to understand the details of company registration in Estonia. At Wisor Group we offer a range of comprehensive solutions designed to simplify the process and align with your unique business requirements.

Option 1: Direct Company Registration in Estonia via Notary with Power of Attorney (POA)

For those seeking a personalised approach, we offer a tailored path to direct company registration in Estonia. This process involves the careful arrangement of registering the company directly in the client's name through the notary. Our team adeptly handles the administrative intricacies, allowing you to focus on your business aspirations.

The Process:

1. Personalised Initiation: Our expert consultants initiate the process in line with your business goals and preferences and gather all relevant information from you to get started.

2. Tailored Solutions: With precision, we guide you through the necessary legal steps, ensuring compliance with the Estonian laws. We also check the company name availability for you.

3. Notary and POA: By issuing a Power of Attorney (POA), you authorise us to act on your behalf in front of the Estonian notary for establishing a company, thus simplifying the entire procedure. However, it is also possible to visit the notary personally with our advisor to set up the business.

4. Company Registration: The company registration takes place under your name, with your unique vision at its core.

Please follow this link for a more detailed guide of the process and required KYC.

Option 2: Company Registration in Estonia for E-Residents

Estonia's pioneering e-residency program has transformed the business landscape, providing a gateway for international entrepreneurs to establish a presence in the European Union. At Wisor Group, our expertise lies in helping e-residents navigate this process with precision.

The Process:

1. E-Residency Advantages: Our experts guide you through the e-residency application process, unlocking access to Estonia's digital ecosystem. The application can be submitted by you online and you can receive the e-residency card itself at the Estonian embassy or in Estonia.

2. Precise Setup: We assist in setting up your company online, ensuring every detail aligns with your requirements. In addition to our advisory services related to the registration, we also offer guidance for utilising your e-residency card for digital signatures, especially if you are new to this process.

3. Digital Presence: With our support, your business takes root in Estonia's digital landscape, enhancing your global reach.

Please follow this link for a more detailed guide of the process and required KYC.

Both of the above options allow you to set up your company here in Estonia remotely. Nevertheless, we always welcome our clients to visit us in beautiful Tallinn to meet us and discuss your further plans with your Estonian company.

Company Registration in Estonia with Wisor Group

Virtual Office and Contact Person Services: Ensuring Compliance and Accessibility

In accordance with the Estonian legal requirements, every company established within the country is obligated to fulfil specific criteria. Among these prerequisites, having a registered office address and a contact person who is a licensed service provider in Estonia stands as a cornerstone of compliance and accessibility. With current regulatory updates it is now also allowed to have a foreign legal address for your Estonian company, however in this case mandatory appointment of contact person is necessary.

Contact Person: Bridging Communication

As stipulated by Estonian law, having a contact person who is a licensed service provider, advocate, notary, attorney at law or notary office in Estonia, is essential in case of a non-resident managed company and in case the company does not hold an Estonian legal address. Contact person serves as a bridge between the company and regulatory bodies playing an important role in receiving official communication and documents on behalf of the company. This communication pathway promotes transparency and guarantees the accessibility and accountability of your company whenever the need arises.

Legal Address: Establishing Presence or not?

Typically Estonian companies have Estonian legal addresses, but as mentioned above, Estonian companies now have the option to use a foreign legal address. This means the company doesn't have to rely solely on an Estonian address and can also receive mail at the foreign address. Having a foreign address requires appointing a contact person, as mentioned earlier.

Choosing a foreign address has its pros and cons. While it reduces the need for a physical presence in Estonia, it might also raise questions about taxes and regulations. It's important to think carefully before making this decision.

Alternatively, you can opt for our virtual office services. Our services include a valid registered address where we handle, forward, and store your company's mail. This is a more practical solution compared to using post boxes as addresses. It's important to note that post boxes are not permissible as legal addresses, further emphasising the need for tangible presence.

Having a proper registered address is crucial for your company's official documents and communication. It establishes your company's presence and ensures compliance with Estonia's rules.

Wisor Group offers different options for fulfilling these legal requirements. Depending on your needs, we offer either contact person and/or legal address services with necessary mail forwarding. Our virtual office and contact person services effectively fulfill these legal requirements with accuracy.

Our Flexibility for Complex Structures

We are well-prepared to manage complex company setups, including registering companies with foreign corporate shareholders, dealing with multiple corporate and individual shareholders and accommodating numerous board members. Our service is always tailored to meet your distinct requirements. Our advisors will guide you through the legal requirements for complex structures and provide the necessary advisory for the setup.

Share Capital

In accordance with Estonian laws, companies are required to have a minimum share capital of €0,01. However, as the shareholder's liability is still €2500, we advise you to state the same amount as the share capital. Our advisors will assist you in determining the appropriate share capital amount and guide you with the required contribution to the designated bank account.

Remote services

If you're interested in establishing your company in Estonia, but find yourself short on time to travel or prefer not to delve into legal intricacies, there's an option to remotely set up your company with our expert assistance. This can be achieved through either a power of attorney or using e-residency.

Opting for the power of attorney route entails visiting a local notary to sign a representation document designated to a Wisor Group legal advisor, who will oversee your company registration. This legal advisor will represent you during the notary process, ultimately securing the setup of your company.

On the other hand, e-residency offers a streamlined process. Our advisors can craft the application for company registration within the online commercial register. Once the application is ready, our team will guide you through digitally signing the petition. This efficient process typically leads to the registration of your company on the very same day.

Expert Guidance for Seamless Company Registration in Estonia

At Wisor Group, our focus is on providing customised solutions that match the changing business environment. Whether you choose direct company registration or utilise the e-residency program, our advisors ensure your transition into the Estonian business environment is smooth, compliant, and aligned with your vision.

FAQ about Company Registration in Estonia

1. What are the types of companies that can be registered in Estonia?

Estonia offers various types of companies, including private limited companies (OÜ), public limited companies (AS), sole proprietors (FIE), and partnerships amongst foundations (SA) and non-profit organisations(MTÜ).

2. What kind of company type should I choose?

In case you are looking to set up a small or medium sized business (either a 1-man company or with multiple partners) we advise you to set up an OSAÜHING (private limited company) in Estonia. In case you are looking to go public, you should think about setting up a AKTSIASELTS (public limited company) and in case you are looking for a foundation or an NGO, we advise for SIHTASUTUS or MITTETULUNDUSÜHING, which are considered non profit foundations/organisations. Wisor Group can assist you in choosing a suitable company type and setting it up compliantly. Please see ordering forms for E-resident company, Company in your name and NGOs. Should you need anything else, please contact us through our general inquiry form.

3. What is the minimum share capital required for company registration in Estonia?

The minimum share capital requirement for private limited companies (OÜ) is €0.01. However, as the shareholder's liability is still €2500, we advise to state that amount as the share capital.

4. Can foreigners or non-residents register a company in Estonia?

Yes, non-residents and foreigners can register a company in Estonia. There are no limitations as to who can set up a company in Estonia. Many also prefer setting up the business through the e-residency, however it is not a mandatory requirement to set up a company in Estonia.

5. What is e-residency, and how does it relate to company registration?

E-residency is a digital identification program offered by the Estonian government, allowing non-residents to access Estonian services and establish a company online, as well as to sign agreements and other documents digitally.

6. Do I need physical presence in Estonia to register a company?

No, physical presence is not always required. Furthermore, Estonian companies can also have foreign legal addresses (in this case Estonian contact person must be appointed). Wisor Group can help you decide whether you would require a physical presence and we can provide you with all the necessary, such as legal address with mail handling in Estonia, contact person services and also local substance services.

7. What is a contact person, and why is it required?

Having a contact person who is a licensed service provider, advocate, notary, attorney at law or notary office in Estonia, is essential in case of a non-resident managed company and in case the company does not hold an Estonian legal address.

8. What is a legal address, and why is it required?

A legal address is the physical address of the company's registered office. It's necessary for receiving official documents and communication from authorities.

9. Can I use a foreign legal address for my Estonian company?

Yes, as of a recent change in law, Estonian companies can now use a foreign legal address. However, appointing a contact person within Estonia is mandatory when choosing a foreign legal address.

10. What are the steps involved in registering a company in Estonia?

The steps include choosing a company type, preparing necessary documents, selecting a legal address and contact person, determining share capital, submitting an application, and registering the company with the Commercial Register.

11. Can I register an Estonian company without an e-residency card?

Yes, you can. That is what the majority of the people do when opening Estonian companies.

12. Can I set up my company in Estonia remotely?

Yes, it is possible to set up the company in Estonia remotely, this is generally done via Power of Attorney (POA). Wisor Group legal advisors will represent you in the notary for the company setup and ensure that the company is registered properly in your name. Alternatively, it is possible to set up a company in Estonia remotely via e-residency.

13. What is the timeline for company registration in Estonia?

The company registration process can take up to 5 business days after signing everything at the notary. E-residency company setup takes usually 1 day after all parties have signed the petition online. These timeframes are indicative and apply in cases when all documentation is ready by the client by the time of the registration application.

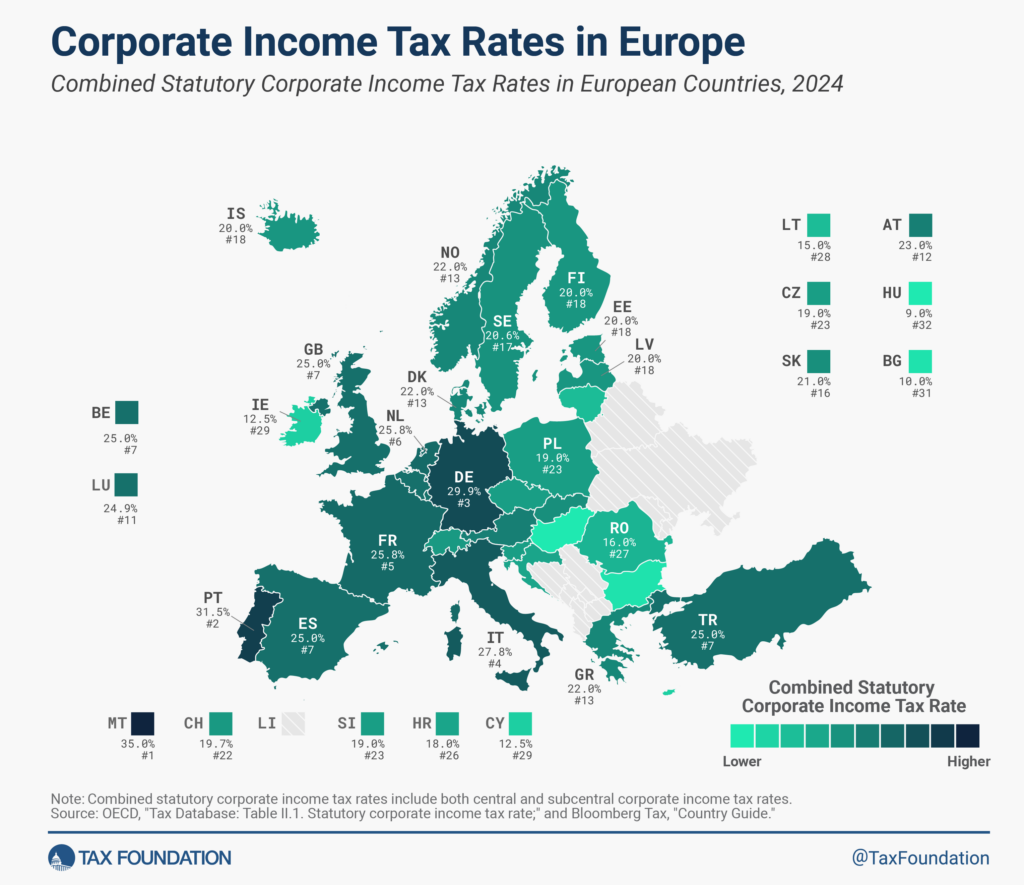

14. What taxes and obligations do registered companies have in Estonia?

Estonian companies do not have corporate income tax on revenue. Estonian companies are taxed for profits only in case dividends (profits taken out) are paid. In this case the 20% corporate income tax rate applies. Estonian companies are also subject to 20% VAT and different salary taxes in case of employees.

15. Can I register a company with complex structures, such as multiple shareholders or board members?

Yes, company registration in Estonia can accommodate various complex structures, including multiple shareholders, board members, and even foreign corporate shareholders. Our professional advisors can guide you through the process.

16. How can professional corporate service providers assist with company registration in Estonia?

Experienced service providers can offer guidance on legal requirements, document preparation, contact person and legal address services, share capital determination, and navigating complex company structures.